Covered Interest Rate Parity Example

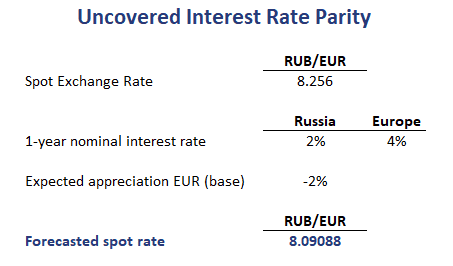

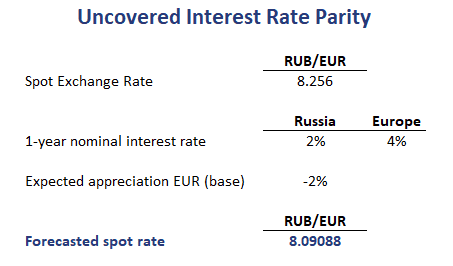

Lets consider an example. When the exposure to foreign exchange risk is uncovered.

Uncovered Interest Rate Parity Breaking Down Finance

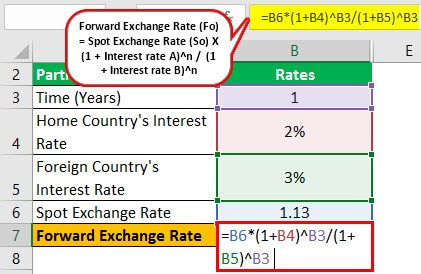

The following table illustrates the use of the formula using a numerical example.

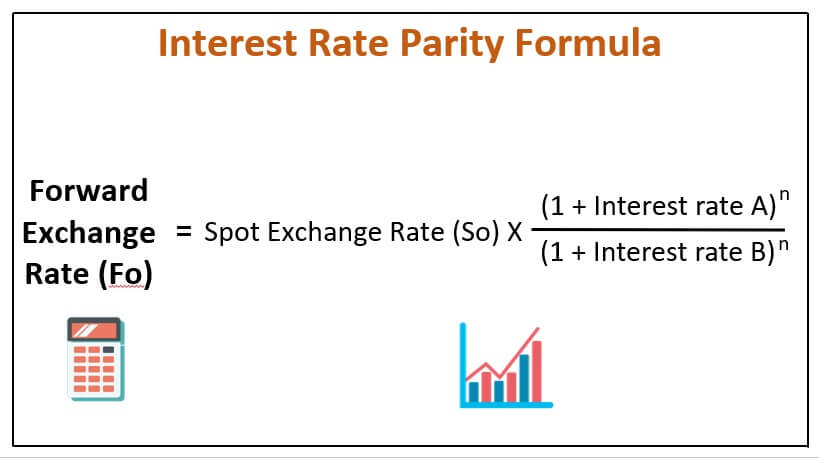

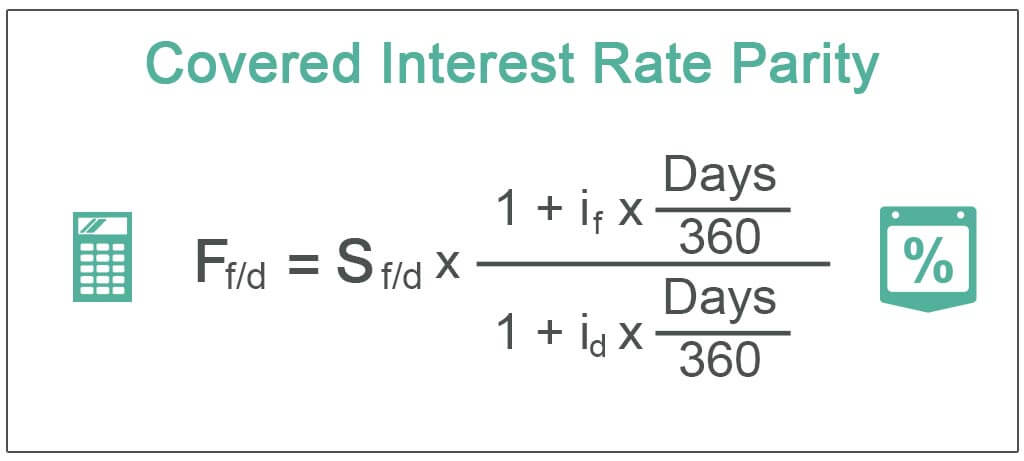

. An investor has two options. When the exchange rate risk is covered by a forward contract the condition is called covered interest rate parity. Lets use the example above to illustrate how interest rate parity works.

Interest rate parity example. Using the covered interest rate parity forward exchange rate is calculated using the Example. So 1000 of 5 for 1 year 105127 Let the forward exchange rate be 120025 1.

We can also invest 1000 in an international market where the rate of interest is 50 for 1 year. This technique would be using uncovered interest rate parity and both should end up with equal cash flows. Invest 1000000 USD in the local market for 6 months at an annual interest rate of.

Covered Interest Rate Parity Example Lets assume Australian Treasury bills are offering an annual interest rate of 175 while US. The domestic interest rates in Country A a developing nation are 9and. Practical Example Assume the nominal interest rate in the US is 6 per annum.

Interest Rate Parity Example Let us now work through an example question involving interest rate parity. Example of Covered Interest Rate Parity Let us understand its concept with the help of a numerical example. Treasury bills are offering an annual interest.

To give another covered interest rate parity example. 61 The Theory of Covered Interest Rate Parity Deriving interest rate parity When the forward rate is priced correctly an investor is indifferent between investing at home or abroad General. As a simple example assume currency X.

Such a limitation often hampers the efficient working of the uncovered interest rate parity equation. Given a spot rate of 113 an interest rate for the of 2 and. Example of Covered Interest Arbitrage Note that forward exchange rates are based on interest rate differentials between two currencies.

Exchange rate between US and British ВЈ on 1 January 2012 was Exchange Rate Real. Covered Interest rate parity example. It states that the forward exchange rate between two currencies will equal the spot exchange rate plus the.

In particular we consider a he covered. Covered interest rate parity is an important concept in international finance. Uncovered interest rate parity UIP theory states that the difference in interest rates between two countries will equal the relative change in currency foreign exchange rates.

Interest Rate Parity Definition Formula How To Calculate

What Is The Interest Rate Parity Irp Corporate Finance Institute

Covered Interest Rate Parity Cirp Definition Formula Example

Comments

Post a Comment